Reports #2

Reports #2

“Global Innovation Index 2020 – Who will finance entrepreneurship?” *

According to the 2020 WIPO Global Innovation Index, firm growth is not that effective on the transformation of innovation into economic benefit, which means that as an innovative company grows, it does not necessarily end up in producing more economic contribution. According to a study, doubling the size of the company can only increase the ratio of R&D to sales by 0.2%.

Since the 2008 economic crisis, we see that government support to entrepreneurial activities has increased, mostly through financial mechanisms. The rationale of these public supports is the positive relationship between employment, economic growth, innovation, entrepreneurship and investment capital, as demonstrated by numerous studies. As we discussed it in a previous article, innovation ecosystems are the architecture of a country’s innovation success. The rest, settles and develops based on this architecture. The main actors of the innovation ecosystem are institutions that produce basic knowledge (universities and research institutions), entrepreneurial companies and financing bodies. The more and more mutual relationships these actors establish with each other, the more successful countries are in innovation.

In the relationship between economic development and innovation, the creative power of new firms had been overlooked by economists for many years. Even Schumpeter, who made the first serious theoretical studies in the field of entrepreneurship, emphasized the innovative advantage of large companies, not small companies.

Over time, this hypothesis seems to have been shelved. The revolutionary technology innovations of small entrepreneurial companies in medical devices, semiconductors, software and especially biotechnology and internet sectors have been remarkable. Even though these companies do not produce key technologies such as genetic engineering or internet protocols, they can be pioneers in terms of “commercial product development success to solve the current problems of humanity”, which is at the basis of the innovation concept. While universities and research institutions are the ones that create key technologies through basic science studies, those who transform this knowledge into commercial opportunities are mostly newly established small companies. This point highlights the importance of technology transfer interfaces and the key role of entrepreneurs in the market. Small innovative initiatives should be financed in some way, more precisely “effectively”, in order to exploit basic knowledge in a way to produce solutions to the current problems of humanity.

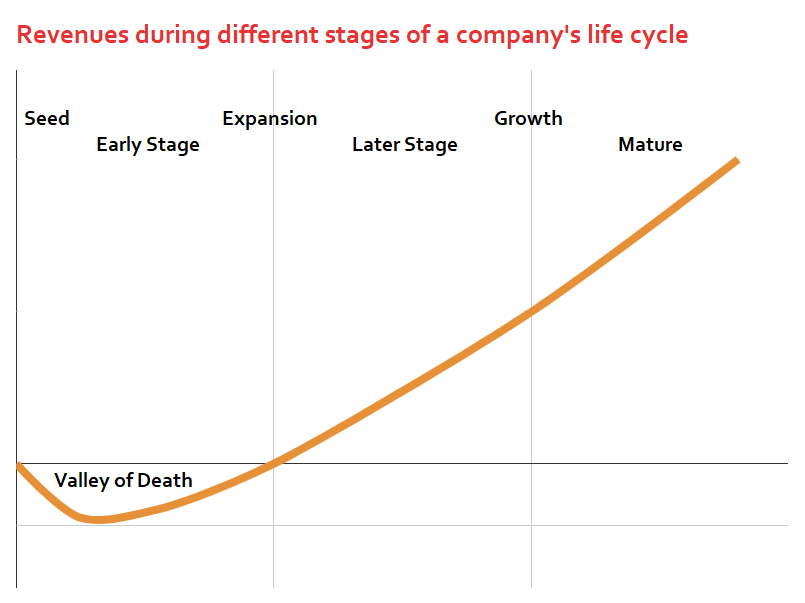

However, when looking at the public support for entrepreneurship, it is seen that these are small starting capitals that will cover the required financing just before the valley of death. A study emphasizes the innovative advantage of small entrepreneurs supported by investment capital, and shows that these companies are more successful than those who are able to get public support. Why does this advantage arise, or if we are to associate it with the core question of the report, why should these small enterprises be financed by venture capital rather than public incentives?

In the answer to this question, “risk” comes forward as the main factor here. New companies usually do not possess sufficient data that allows the investor to accurately and precisely analyze their potential. In addition to the lack of data, it is also uncertain whether the entrepreneur will act opportunistically once they have accessed the investment, which increases the risk significantly. Among the mechanisms developed in response to these problems are technology valuation (due diligence) and interview processes that venture capitalists use to make investment decisions. Due to the highly selective nature of these processes (investment rate of 0.5-1%), venture capital is much more efficient than public supports in terms of innovation (not basic research or seed capital) financing. The staged/rounded financing based on the milestones determined according to the market success or the technological progress made, increases the effect of the investment as it requires continuous interaction between the parties. An idea continues to receive funding as long as the success of the entrepreneur continues. The constant involvement of the investor is a factor that increases this success. Venture capital, while satisfying the financial hunger of young companies striving to overcome the valley of death, contributes to the restructuring needed by scaling companies. Entrepreneurs can invest more in R&D and market activities with this guidance and financing.

As Refo, we attach importance to understanding the nature of the relationship between this economic development and innovation and to shape our activities and services accordingly. We have accelerated our “technology valuation” studies, which we believe are important in terms of meeting young enterprises with venture capital for a strong innovation ecosystem. You can contact us for your support needs.

* This article is a review based on the fifth chapter of WIPO Global Innovation Index 2020 – Government Incentives for Entrepreneurship.